When you are travelling the world or shopping online, you’ll notice there are different currency prices quoted for different countries.

Contrary to what many people believe, the stock market is not the most popular market in the world; in fact, the biggest and most liquid market in the world is the spot forex market. This market facilitates the instant exchange of currencies online. This is the market price to buy or sell a currency – right now, which is what the term ‘spot’ means. If the ‘spot market’ means – right now, then the currency futures market means – in the future, and that market trades in contracts at the CME Group – a popular future’s exchange.

Currency futures have a specific delivery date that affects the quoted price. Namely, this is due to changes in interest rates between now and the future date that you wish to buy the currency. So while your forex broker may list EUR/USD for 1.17, the futures contract may have it priced at 1.1730.

Finally, there is a market for the physical currency. When you travel and arrive at the airport, you will notice many kiosks trying to convince you to exchange your home country currency for the currency of the country you are traveling to – if different of course. Quick tip on this one, you will generally get a much better rate if you withdraw money from your credit card at the ATM/ABM – assuming your card company does not charge you massive international withdrawal fees.

When you think of the physical cash you hold on your person, the spot forex market, or the futures forex market, you should think of those three things as very separate. Most active forex traders will trade in the spot forex market.

ADVANTAGES OF TRADING FOREX

Here are a few examples of the advantages of forex trading:

- Almost always open – 24-hour trading. The forex market is open 24 hours a day from Sunday at 5 PM ET to Friday at 5 PM ET. This is great for anyone interested in Forex trading, whether part time or full time.

- Low capital requirements with low minimum trade sizes. Forex trading also allows you to trade in very small sizes, which allow traders to open smaller accounts. Forex traders can open positions in standard lot sizes, mini lots or micro lots.

A standard lot is 100,000 units of the base currency, which is the first currency listed in a pair. In EUR/USD, a standard lot would be €100,000 (approximately $111,000). In any U.S. Dollar-based pair, like USD/JPY, USD/CAD, or USD/CHF, a standard lot is $100,000. Mini lots are 10,000 units of the base currency, while a micro lot is just 1,000 units of a base currency. On the Metatrader 4 platform, you could take a position of 100,000 units on EUR/USD by writing 1.00 like this:

You can buy a Mini contract worth 10,000 units buy entering 0.10 in the order ticket like this:

And finally you can buy one micro contract worth 1000 units by entering 0.01 in the order ticket like this:

- Ultra liquid market. Unlike other markets that trade 24 hours a day, like certain products on the futures market, the forex market is highly liquid for much of the day, particularly during times when one major market overlaps with another.

Here’s an easy example, think about it this way, when it’s 8am in London – England, it’s roughly 2am in America. 6 hours later, the US market opens and the London market is still open right? So now, you have two massive markets open at the same time, this is when the liquidity would be at its highest and it’s when most people like to place their trades.

- Buy if you think it is going up; sell if you think it’s going down – it’s that easy. If your background is not in stock or options trading, it might be difficult for you to understand how it’s possible for you to sell something when you haven’t already purchased it.

Let’s quickly explain how it would work:

- You believe that Facebook stock is overvalued and don’t believe it will continue going up.

- You ask your broker to borrow Facebook Shares

- The broker verifies to see if they have Facebook Shares available to lend you – this term is called “locate” and is popular in the finance world

- If they have shares available, they agree to lend them to you, but they will eventually want them back

- Take note that the broker does not care at what price you return the shares, they simple want them back

- The moment the broker lends you the shares, you sell them at the current price of say 100 dollars – let’s say you borrowed 100 shares in our example which means you sold 100 shares of Facebook at a price of 100 dollars, this would give you 10,000 dollars.

- Let’s say the price of Facebook over the next few weeks goes down to 90 dollars per share

- You now decide that it’s a good time to buy 100 shares so you can return them to the broker

- You now purchase 100 shares at 90 dollars per share for a total of 9,000 dollars

- You return 100 shares to the broker as promised

- You received 10,000 from selling 100 shares at 100 dollars

- You paid 9,000 to buy 100 shares at 100 dollars to give them back to the broker

- You have earned 1,000 dollars in profit from selling a stock without owning it first – thanks to the broker lending you the shares (excluding any commissions cost)

With most brokers, you’ll be able to short-sell stocks as long as they are very liquid –usually big popular companies. With Forex and CFDs, you don’t need to worry as you can short-sell pretty much anything on the trading platform and all the steps above happen automatically – you still need to decide when to buy and when to sell of course. Regardless of which side of the trade you are on, the margin requirements are the same. This means that you can more easily capture rising or falling prices.

- Variety is the spice of life. If a trader is optimistic about the U.S. Dollar, there are a variety of currency pairs to choose from to express that view – literally hundreds!

FOREX TRADING ORDER TYPES

There are many different types of orders that traders can use to implement their preferred trading strategy.

A market order places a trade at the current market price, wherever that may be. This may be better or worse than the price that a trader sees on his or her screen, especially if the market is moving fast. Advantage: this order executes right away at the next tradable price. Disadvantage: this order may execute at a price other than what the trader sees on their display or at a price significantly worse than what a trader wants in a fast-moving or gapping market. This is one of the worst orders to place for execution but one of the best for reliability. You can be confident that you will get filled, but at what price is the real question.

LIMIT ORDER

A limit order is an order that is executed at or better than the trader’s named price or not at all. You either get your price, or the order doesn’t trigger. Advantage: the investor is in control of the exact price they will receive. Disadvantage: there is no guarantee that your order will go through, if the price never hits that price, you won’t get filled.

STOP ORDER

A stop order can either be placed as a stop limit, this is often called a take profit in buy positions, or a stop market order, which could also be called a stop loss. The most common is a stop market order, which will get the trader out of the market when a particular price is hit. It’s important to mention that unlike limit orders, a stop is simply an order to execute at “market” when the price is triggered. Just because your stop is triggered, does not mean you will be filled at that price. This is an order type that typically prevents additional losses. A stop will take a trader out of their position when the price reaches a set level. If you are long GBP/USD, a stop would be an order to sell GBP/USD at a lower price underneath the market price where you entered the trade. Advantage: the trader is more protected in case the market quickly reverses on them Disadvantage: there is no guarantee to what that price will be. Remember, this is simply a trigger to execute a market order, very different from a limit order.

TRAILING STOP ORDER

If you’re looking for an order to move along with your profitable position so that if the market turns sharply, you still get to keep the majority of your gains, then you are looking for a trailing stop loss. This order is very valuable for those able to identify the beginner of long term trends. If a trader is long the popular US index – Dow Jones 30, trading at 20,000 with a 500 point trailing stop and an initial stop at 19,500, their stop will automatically move as the US index moves higher. If the index gets to 20,500, the 19,500 stop will adjust to 20,000. It will stay there until it is hit or the Dow Jones gets to 21,000, at which point the stop will adjust to 20,500. The stop will continue to trail the price until it is hit or until the position is closed manually. Note that in this example, we are moving by 500 but the moment the trade is profitable, the trailing stop loss begins to “trail” and move with the trade.

Advantage: great for capturing large moves in the market and to secure profits as the market rises, like in the above example where the US market was in an uptrend for 10 years!

Disadvantage: A trailing stop loss does not take into consideration support and resistance or any other technical factors

GOOD ‘TIL CANCELLED

This is more of an extra option when someone places a trade, I can place a pending buy order in the market and then label that order as “GTC” which simply means it will just stay open until I manually close it. By default, most brokers set your orders with a GTC label, you can easily change this to 2 days or any other timeframe you prefer.

Advantage: no need to jump in the market right away if you’re looking for a specific price. If you’re patient, this can be a great way to find bargain prices.

Disadvantage: you can forget you’ve placed this order. If the market conditions change, it’s possible you don’t want to take that same trade but if this order is still pending, it could still trigger.

GOOD FOR THE DAY

Similar to GTC, this order is active for the trading day and will be automatically cancelled at 5 PM ET. Note that 4pm ET might be the close of the US stock market and that’s when this order would be cancelled if you had placed this order on Apple stock, for example.

Advantage: very useful for day traders who close all trades at the end of the day, it ensures you don’t forget to cancel an order you no longer want filled.

Disadvantage: not useful for orders you always want to remain open, like stop loss orders that protect you in case of market reversals.

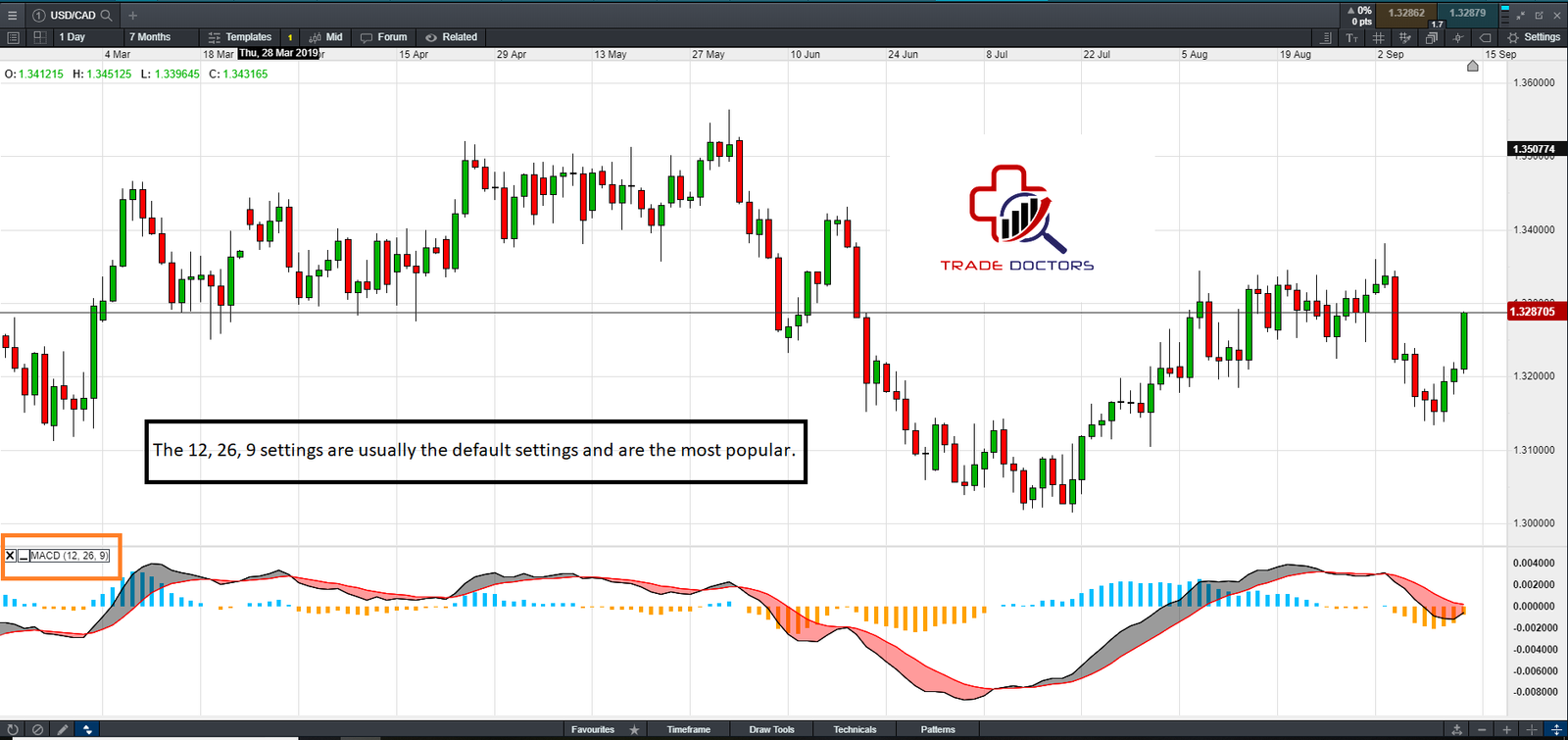

MOVING AVERAGE CONVERGENCE / DIVERGENCE (MACD)

The MACD is an indicator that gauges momentum of a trend, showing the relationship between two moving averages. The MACD subtracts the 26-day exponential moving average (EMA) from the 12-day EMA and compares it against a 9-day EMA. The 9-day EMA is used to trigger the buy or sell signals.

SIMPLE MOVING AVERAGES

A simple moving average is the average price of a currency pair over a specific period. Many forex traders will use a 21-period moving average. For longer term trends, traders may look at 100-day and 200-day moving averages. The line drawn on the chart shows the average price trend. The longer the period, the more important the trend. Some traders look to buy when price rises above a moving average or sell when price falls below a moving average. They could also place trades when two moving averages cross over or under one another – these trading strategies are very simple and very popular.

EXPONENTIAL MOVING AVERAGES

An exponential moving average (EMA) is similar to the simple moving average above, except that it puts more weight on recent prices. An EMA still uses the prices over the past “x” periods of time, where “x” is any number and the period can be minutes, hours, days, weeks or months. The shorter the period, the more weight that the closer time periods receive.

BOLLINGER BANDS

The Bollinger Band indicator was invented by John Bollinger, this indicator is often included in many trading brochures and trading courses. A Bollinger Band has a moving average in the middle of two bands, one upper band and one lower band. The distance between the bands are set to two standard deviations away from the moving average. Traders use the two bands as dynamic support and resistance levels.

FIBONACCI RETRACEMENTS AND OTHER FIB TOOLS

Fibonacci levels are used to predict where a market may extend or pull back to, using the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%. These are basically measured move calculations from two extreme points on a chart. As many traders do not use these levels properly, it is very good to know the effectiveness of Fibonacci Retracement and Fibonacci Extensions depend heavily on where you draw them.

ICHIMOKU CLOUD

One of those indicators that gives new traders headaches by simply looking at the chart. The Ichimoku Cloud is another measure of trend and momentum that highlights potential bullish and bearish crossovers. The colour of the cloud changes based on whether the indicator signals a bullish or bearing trend, and the cloud also indicates expected levels of support or resistance.

RELATIVE STRENGTH INDEX (RSI)

Arguably the most simple indicator. The RSI looks to identify when an investment is overbought or oversold. The RSI is an oscillator that offers a reading between 0 and 100. A value of 100 is considered overbought, indicating a reversal to the downside could be likely. A value of 0 is considered oversold, signalling a possible change in trend to the upside. Levels above 70 and below 30 are considered important inflection points and are usually part of many trading plans.

WHAT MAKES THE FOREX MARKET MOVE?

Due to the number of diverse participants that trade forex markets, including banks, international corporations, central banks, brokers, international investors and retail traders, many factors impact the market — from long-term capital movement to day-to-day trade flows to speculation. However, the most important factor impacting foreign exchange markets is monetary policy, particularly, interest rate decisions.

In general, traders prefer countries and currencies with higher interest rates over countries with lower interest rates. This flow of money is typically referred to as the “carry trade” or “holding cost” or the “swap” or the “overnight rate”. There’s a main central bank for each country and that bank sets the appropriate interest rate for that country. Each central bank makes policy decisions with different objectives in mind.

In the United States of America, the Federal Reserve has two objectives, to maximize employment and keep prices as stable as possible. The Bank of Japan and European Central Bank, however, have one job and that job is to keep prices stable and ensure inflation rates remain within healthy levels.

WHAT ARE THE MOST IMPORTANT ECONOMIC REPORTS TO FOREX TRADERS?

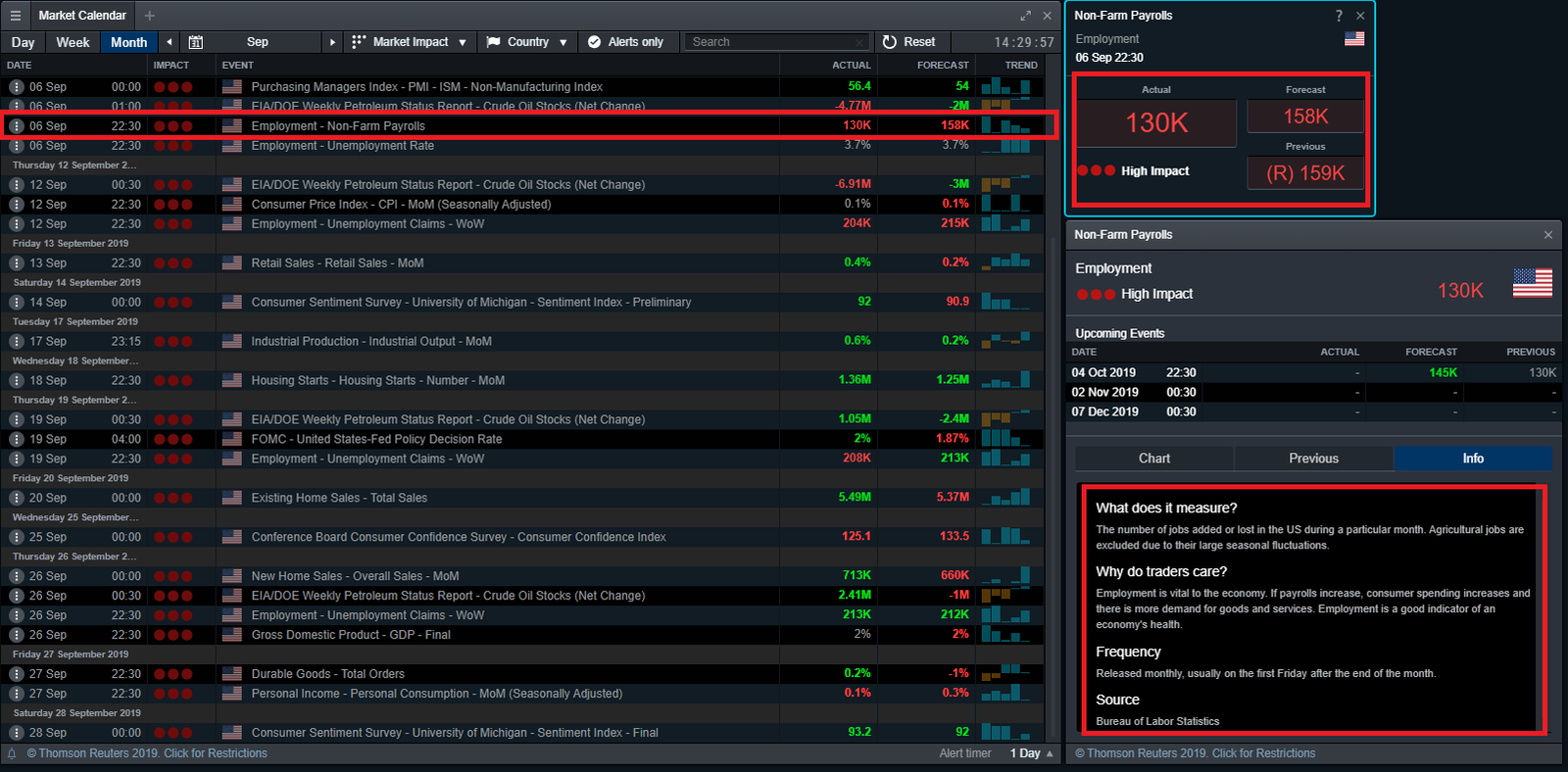

Since interest rates really drive the forex markets, the most important economic figures are those that directly report on interest-rate policy. That includes measures of inflation, like consumer and producer price indices, quarterly GDP reports, and monthly employment figures like the Non-Farm Payroll report. This is an example of an Economic Report that you can find in many trading platforms:

Whenever you are looking at these reports, it’s not enough to simply look at the number. You need to have a feel for what the general consensus is, it’s not the number that makes the market move, it’s how different the actual number is from the forecast figure. For example, if I tell you that central banks will lower interest rates next month with a 90% probability. You, along with many other traders, will be selling that currency today. By next month, if the bank does in fact cut interest rates by the forecast amount, you should not be expecting a large reaction since this news has already been priced in. However, if the bank doesn’t cut interest rates, but instead, increases them, you can expect a massive amount of volatility and that currency to rise against all others due to this “surprise” in reporting. Analysts and Economist attempt to estimate forecasts but are often wrong and this miscalculation leads to market volatility which is what traders want = more trade setups.

HOW MUCH LEVERAGE SHOULD YOU USE?

Many traders are attracted to forex because it offers massive leverage with low minimum account sizes. However, leverage is a double-edged sword that can destroy an account just as quickly as it can make someone rich. Forex is one of the few things in life that doesn’t fit the expression “it takes money to make money”. Sure, you do need money but the size of your trades should be proportionate to the amount of money in your trading account. For example, many brokers will allow you to take a trade worth $500,000 with as little as $1000 in your trading account. Keep reading below before you open your digital wallet. To be honest, the amount of leverage isn’t important to experienced traders and those who actually make money on a consistent basis. Big leverage is really only good for the gambler and the broker, and rarely – the scalper. Instead of viewing trades in terms of maximum leverage, traders should think very carefully about their position size as they look to enter a trade. There are a number of complex ways to determine what the appropriate position size is but it’s best to simply ask two questions:

- How much can you afford to lose on any one trade.

- What is the point at which your trade is proven wrong.

For example, if you decide you can afford to lose $100 on a GBP/USD trade and that the point at which your trade idea is proven wrong is 30 pips away, your position size should be 33,333 units. If you determine that you can lose $100 on a GBP/USD trade and that your trade idea will be proved incorrect 20 pips away, you’d be able to use a slightly bigger trade at 50,000 units. At the end of the day, a trader’s particular strategy will determine what that amount of leverage is and whether it fluctuates or is constant. If a trader is a scalper, then they may employ more leverage because their stops are closer to the entry point. Their trades may also be more consistent. On the other hand, if a trader prefers a swing trading strategy, they might use less leverage that varies from position to position. The number one reason trader’s fail is because they use too much leverage and incorrect position sizing = simple. This whole section may soon become a thing of the past as regulators all over the world are cracking down on high leveraged trading accounts that provide 500:1 leverage. In Australia for example, ASIC – the financial regulatory out there, has recently proposed a reduction of the maximum leverage from 500:1 to 20:1 for retail clients – that’s a BIG difference and the entire industry will feel the impact. To really understand how margin and leverage work. Watch this brief 3 minute video on margin. It does not matter if we are talking about commodities, forex, stocks, CFDs, margin and leverage principles are the same. If you understand the video below, you understand margin and leverage.

FOREX CURRENCY CORRELATIONS

For the most part, all currencies are interrelated. However, understanding how currencies are correlated with one another can help forex traders maximize profits and limit their losses. For example, the Australian Dollar, Canadian Dollar and New Zealand Dollar are known as “commodity currencies” and generally move with one another. As an example, the Canadian Dollar is often referred to as the “Petro Dollar” since much of its value is tied to the country’s biggest export – Oil. If 2 of the 3 currencies are moving in tandem but the 3rd is behaving differently, there may be an opportunity for a trade for the keen trader. Using correlations between stocks and asset classes is a common method of lowering a portfolios standard deviation which reduces the volatility of the overall portfolio. Many brokers provide free and advanced trading tools such as correlation matrices that can be incorporated in a trader’s strategy. Here is an example of what a matrix like that would look like in MT4:

POPULAR FOREX TRADING STYLES

There are four major types of trading strategies: (1) day trading (2) scalping (3) swing trading, and (4) position trading.

Day Trading — A day trader enters trades at any point throughout the day, but will always close trades at the end of the day, seldom leaving them open more than 1 day. This type of trader is looking to catch the main trend for the day and may hold trades for anywhere from minutes to a few hours at a time. They are aware of long-term trends, but may take the other side if that’s where prices are moving that day, also known as the counter trade.

Scalping — Scalping is the act of looking for a few pips in a trade at a time. This type of trading is very exciting and requires the most focus. These trades are typically held for just a few minutes and are based off of short-term and intraday charts. A scalper is likely to employ more leverage and make more trades each day than the three other types of traders. A scalper has no loyalty to being short or being long, they take the trade the markets give them. It’s worth noting that brokers absolutely love scalpers as they are known to place several large trades every day and pay a great deal in spreads – often qualifying for premium rebates and preferred account management services.

Swing Trading — Many successful traders are swing traders. Those traders place fewer trades, base their analysis on larger more reliable time frames and don’t let sporadic news stop them out. A swing trader is a longer-term trader that looks to profit on moves over a couple days to a week in duration. This trader will look for inflection points, like buying as a currency pair breaks through major resistance or selling if it breaks below major support, also known as breakout strategies.

Position Trading — A great style for busy individuals. This trader thinks of trades in terms of long-term moves and may look to catch a trend for weeks or months. This trader is the most likely to scale into their position over time and tends to have a strong bias for where prices are heading. These type of traders may also consider fundamental factors in determining their longer term positions.

BEST FOREX TRADING STRATEGIES

Many people look for the secret strategy and one that will make them winners, but in fact, the most difficult part of trading is not knowing whether the price will go up, or go down. It’s knowing when to take your profit and when to cut your losses. The only way to perform this latter action is by having confidence in your trading plan and strategy. If someone simply buys a course and trades the strategy, they are likely not going to be successful as they’ve never back tested the strategy themselves and have no clue how the statistics of their plan will look. They may win a few trades here and there, but disappointment is almost certain. Here are five important questions to consider when developing and implementing a trading strategy:

- What is the market state? The market state will tell you if a currency pair is trending or range-bound. That can help inform what the best trading strategy is for this particular period of time. For example, if the market is consolidating within a range, it may not be an appropriate time to be using a trend strategy.

- To someone starting out, this next question sounds a bit ridiculous but experienced traders will understand it all too well. What is the strategy that matches with my personality the best? By far, the most important factor when it comes to a trading strategy is how it fits with your personality. Are you patient? Do you need instant gratification? Do you hate losing? Traders need a strategy that accentuates their strengths and minimizes their weaknesses. If they are impatient and prone to self-doubt, they’ll likely want to stay away from a strategy where their holding period will be days, such as scalping. If on the other hand, they are more deliberate and thoughtful and are not looking for constant action, then they may do well swing trading.

- Do I prefer fundamental or technical analysis? If you’re planning on holding the trade for a longer period, the more important fundamental analysis becomes. While a trader should always look at important support and resistance levels, especially on the daily and weekly time frames, technical analysis can be incredibly effective on shorter time frames.

- What is my risk tolerance? Regardless if you’re a short term scalper or someone placing one trade a month, you need to know exactly how much you’re risking prior to taking each trade. By most professional opinions, 2% of your capital is the maximum you should be willing to risk per trade. For example, if you have 10,000 dollars in a trading account, $200 is the most you should be losing on any one trade. You need to define a clear risk tolerance policy in your trading plan.

- Are there special circumstances that can affect my trading today? Other factors like high impact economic reports, Brexit etc… You can also include your current emotional state in this category. Are you drunk? Are you grieving from recently losing a loved one? These events all play a part in your trading. Other factors may also impact a trader’s strategy, such as the time of day she is available to trade or factors related to the currency spreads or commissions. For example, a trader may find it more challenging to scalp if her broker is not extremely competitive on spreads.

HOW TO BECOME SUCCESSFUL IN FOREX TRADING?

Forex trading is accessible, exciting, educational, flexible and offers traders lots of opportunities. Despite all this, many traders are not able to achieve good results in this market. In fact, the majority of Forex traders are losing money.

Learning to trade Forex and learning how to trade in general can be difficult, and that’s why people need help and we’re hoping to offer that here. This page alone is not enough to make you a successful Forex trader but it will explain what it takes, the rest is up to you and will require effort. It will show you the best trading practices for those just starting out. Just by reading this, you are already on the right path to becoming a successful Forex trader. Below, you will find actionable advice for beginners and pros alike.

Let’s get to it. To start, let’s get serious. The first step when it comes to trading Forex is to understand what you want to achieve. This is also known as goal setting and it’s just as important here as with every aspect of your life. In deciding what you want, you have to be realistic. Set yourself a realistic and measurable goal. This could be something like: achieve 30% annual return on investment, earn 1000 USD of profit, get a total of 200 pips per month or something similar. Whatever you decide, your goal should be S.M.A.R.T! SMART is an acronym that stands for Specific, Measurable, Attainable, Relevant and Time Based. Once you have set your main trading goals for the year, it is now time to start learning how to achieve it. The best way is to catalog all the resources that are available to you. This may include the size of your deposit, a friend you know who has been trading for a long time, the amount of time you are willing to spend on trading, and the amount of available funds you are willing to spend on trading-related items like education and software.

Once you have a clear vision, let’s jump to the next step. You now have a goal and you know how much you have available to make that goal happen, it is time to make an action plan. This action plan is more of a brainstorming session until you gather the knowledge required to build a proper trading plan. In this action plan, you can include what asset class you’re interested in, what times of day you’d like to trade and how much time you can spend trading, on average.

IMPORTANCE OF FOREX EDUCATION

The biggest market in the world is constantly changing, so traders need to be able to understand the type of market they are currently trading.

Is the market trading sideways? Is it trending? Is it pulling back into a counter trend? There is no patterned formula or set of rules to guarantee success in trading. Instead it is a combination of many things all at once – and to succeed in this market traders need to be patient, talented and mindful. Those 3 words are synonyms of the success formula we defined earlier, Effort + Knowledge + Experience = Success ….just to remind you.

Being able to talk about draw downs, ratios, charts, stochastic, indexes and trading in general should be regarded as a skill to aspire to when you start to learn about Forex trading. I personally hate it when people say, take your time and don’t rush anything, so I won’t say that here. Instead, commit what you can to learning about Forex trading.

Realistically, you can learn a tremendous amount in 1 month if you’re a quick study and live and breathe this stuff. The part that requires more practice and patience is demo trading. If you don’t want to spend 6 months practicing on a demo account, you can use back testing as an incredible experience boost to speed up your learning by years, so in the end, it’s up to you. You need to be able to constantly evaluate your performance, and understand the reasons behind your wins and losses. So where do you go from here? Here are a few simple steps to get you started.

8 STEPS TO SUCCESSFUL FOREX TRADING

Never, and I mean NEVER – Procrastinate

This is a vital step in becoming a successful trader. Successful people never put off until tomorrow something they can do today. This is even more important when trading Forex. You have to take every opportunity to achieve your trading goals. This is why you have to develop a habit of never procrastinating. The best way to do that is just keep at it. Human beings love progress, so just do something small everyday and you’ll get there.

Practice

The secret to all successful athletes. Since we’re on the topic of demo trading, there’s a good phrase you probably have heard already – “Practice makes perfect”. With a demo account, you can practice to your heart’s content. This is very helpful when you want to get the feel of the trading platform and get acquainted with its features and trading functions.

Learn

Never has this been so important. After all, everyone understands the importance of a proper education. The best way to learn is to continue doing what you are doing now – reading, practicing and refining. You don’t need to pay tens of thousands of dollars for an Ivy league education. We highly recommend reading published hard copy books. Many people say there are no shortcuts but I disagree, there are shortcuts. These shortcuts come in the form of educational videos. It’s like skipping the readings in high school and just watching the movie. You can do this with Forex trading as well but at some point, you’ll actually have to write the book report, which is what we call a trading plan.

Recognition

Recognize your limits regarding your financial capital. Acknowledge you are not a hedge fund. Recognize you should not be losing more than 2% per trade. Recognize that other people have achieved success in trading and those people are rare. Recognize you need to be better than the average trader.

Invest what you can afford

The best tip for any new trader is to start with small amounts and only increase the size of your account with your profit – and not through further deposits, that would be cheating! You don’t have to invest a large amount to earn profit. Keep your trades small and look for consistent upticks in the size of your capital. If you don’t have a lot of money, it doesn’t matter. Once you are consistently profitable, you’ll be able to take your demo trading statement to any propriety trading firm and they’ll give you a chance. If you don’t know what a prop firm is, google it or send us a message.

Start with a single product

Forex trading is complicated due to the unpredictable nature of markets, different events, and the tenacity of its participants. It’s impossible to always be correct. We recommend starting with one product at first – preferably one you are familiar with and can easily update yourself on. When I started, I loved trading Crude Oil as that’s my country’s #1 export. I felt I had a lot of available information due to wide news coverage and I was simply more comfortable with that product compared to others.

Control your emotions

By far, the most difficult thing in trading is not following your emotions. Giving into panic, greediness or excitement is a sure way to collapse your trading career. Try and maintain a logical and practical approach to your trading. This is easier said than done. I remember skipping past all the psychology sections when I was learning about trading many years ago. The truth is, if you’re starting out, you won’t give this section the time it deserves until you blow up your account – this is just part of the learning curve and is absolutely normal – unless you’re not human….

Keep a record

This is one that is more work administratively but profitable traders swear by it. We should learn from our mistakes, and this is even more important and necessary in Forex trading. Keep a record of your successes and failures, and any key mistakes and positive steps that you have taken in order to achieve your desired profit. This is an important step in learning how to be successful in FX trading. Again, we humans like progress. Once you start keeping a diary or folder of your successful and unsuccessful trades, this becomes routine and easy and crucial to growing as a successful trader.

This guide is a bit longer than expected but hopefully it serves as a solid base to start your journey or get you back on track if you’ve been having a hard time. Look, trading is super simple, but it’s not easy. Most people can look at a chart and tell you with reasonable accuracy whether the price will go up or down, that’s not the problem. The problem is by how much will it go up or down and when do you take your profits and when do you cut your losses? Only back testing your strategies and optimizing them for the current environment can help you with that and that’s what the successful traders know. You’ll often see pictures of “traders” on the beach with their laptops who seemingly make thousands of dollars striking a few keys on their laptops while basking in the sun…

Personally, I’ve tried doing that and it’s absolutely not practical:

- The glare coming off the screen from the sun makes it damn near impossible to see the candles on the chart

- The sunscreen residue on your hands makes it very difficult to use the track pad (laptop mouse)

- The distractions make it impossible on their own – you know of which I speak.

Most of the time, myself and other traders in our group take longer swing positions before our holidays and simply track the positions via the MT4 app on our phones. I don’t even need to take the laptop on holiday, that’s the real dream.

“A peak performance trader is totally committed to being the best and doing whatever it takes to be the best. He feels totally responsible for whatever happens and thus can learn from mistakes. These people typically have a working business plan for trading because they treat trading as a business.”

This post is also available in: French